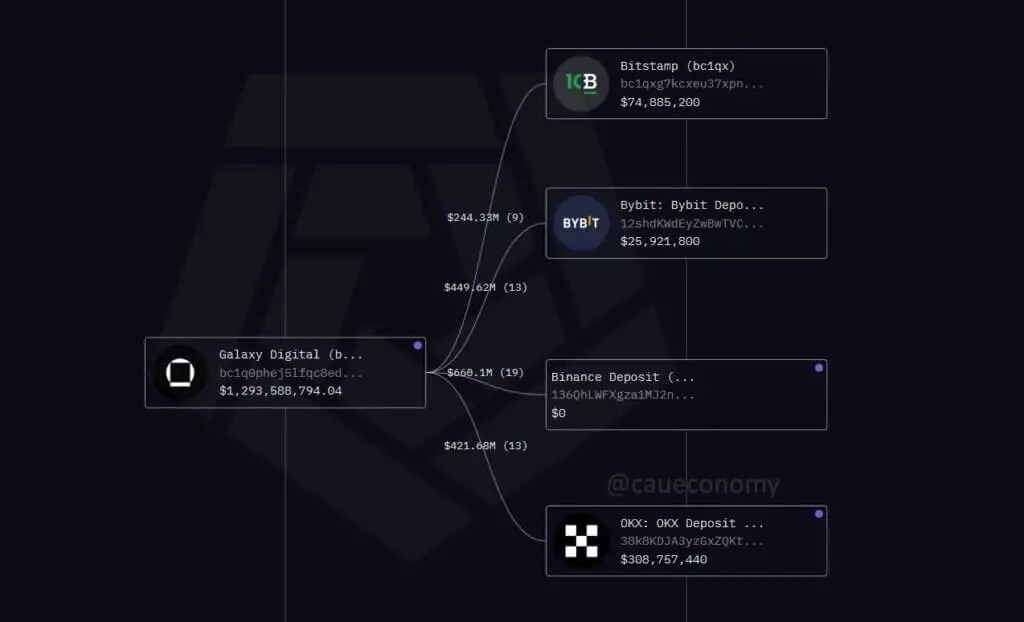

Recent data reveals a significant movement of Bitcoin from Galaxy Digital, one of the most prominent institutional players, involving the transfer of over 17,000 BTC—valued at approximately $1.7 billion—within a mere 24 hours. This wave of transactions raises critical questions about the current health and future trajectory of the crypto market. While some interpret this as an internal reorganization or strategic asset redistribution, others see it as a precursor to a broader market sell-off. The timing coincides with Bitcoin’s recent 2.5% dip, trading just above $115,600, amid heightened daily volumes exceeding $94 billion. The aggressive outflow from Galaxy Digital, primarily directed towards major exchanges like Binance and OKX, indicates a deliberate attempt to liquidate or reposition assets, possibly in response to institutional reassessment or external economic pressures.

The Underlying Strategy or Sign of Trouble?

A closer look at the transaction patterns reveals a calculated approach. The transfer of 80,000 BTC accumulated from dormant wallets dating back to 2011 suggests a consolidation phase, culminating in substantial distribution. The staggered movement of Bitcoin to exchange hot wallets, often associated with distribution, signals that Galaxy Digital might be preparing to offload its holdings. Notably, the largest deposit—10,000 BTC in a single transaction—appears to be a custodial transfer, possibly indicative of internal asset management rather than casual trading activity. However, the duration of static balances following these deposits hints at a strategic shift rather than haphazard selling. This nuanced behavior underscores a broader trend where institutional actors might be acting as market thermometers, signaling impending waves of sell pressure.

Market Implications and the Broader Picture

The presence of such massive inflows and outflows within a short timeframe inevitably influences market sentiment. Analysts, including Cauê Oliveira of BlockTrends, have identified net outflows of approximately 40,000 BTC over the past week, mainly from large wallets, with minimal liquidity to absorb further selling. This scenario fuels concerns about the sustainability of Bitcoin’s recent recovery, especially as traders respond to the increased supply with caution. The transition of Bitcoin from long-held dormant wallets to actively traded accounts further suggests a strategic unwind, possibly reflecting a broader institutional shift rather than panic. While some purport that this unfolding trend might lead to downward pressure, it could also serve as a healthy correction—an opportunity for selective investors to reassess their positions in a market that has, in recent months, exhibited a remarkable capacity for resilience.

Is This the Beginning of the Next Market Downturn?

Despite the provocative activity outlined above, it is crucial not to succumb to panic. The divergence between on-chain movements and market sentiment reveals a complex landscape where strategic asset repositioning does not automatically equate to an impending crash. In fact, this may be the result of institutions preparing to reenter or stabilize their holdings, emphasizing a cautious but resolute approach. The $115,600 level for Bitcoin is not only a price point but also a psychological barrier—one that could be tested as these large transfers unfold. The true challenge lies in discerning whether these massive withdrawals are signs of institutional profit-taking or if they portend a broader bearish trend. For the centrist, pragmatic investor, this situation underscores the importance of remaining vigilant, strategic, and critically aware of the on-chain signals that may define the next phase in Bitcoin’s cycle.

Leave a Reply