Category: Exchanges

BitGo’s IPO Push Sparks Optimism and Cautions Doubt About Crypto Industry’s Future

The announcement of BitGo’s impending IPO, revealing projected revenues exceeding $3 billion in 2024, marks a pivotal moment in the cryptocurrency sector. Critics have long dismissed the industry as speculative and unsustainable, yet BitGo’s numbers scream otherwise. A growth rate of over 200%, from roughly $926 million in 2023 to more than triple that in…

Why Regulatory Oversight of Binance Derails Public Trust and Financial Stability

In recent months, the spotlight has shone brightly on Binance, the world’s largest cryptocurrency exchange, revealing a disconcerting gap between regulatory promises and actual practices. Despite a hefty $4.3 billion settlement, questions linger about whether Binance is truly adhering to its obligations. The silence and vague responses from federal authorities further fuel skepticism that a…

Gemini’s Bold IPO Strategy: A Reckless Gamble or a Smart Move?

Gemini’s decision to pursue a public listing amid volatile market conditions underscores both daring ambition and an underlying risk. The cryptocurrency exchange, backed by the renowned Winklevoss twins, has aligned itself with Nasdaq, a move that signals a push to legitimize digital assets within mainstream financial markets. However, this collaboration is fraught with tension. While…

Giwa: The Bold Gamble to Dominate South Korea’s Digital Economy

Upbit’s recent cryptic countdown to unveiling Giwa signals more than just another blockchain initiative; it underscores South Korea’s accelerating race toward technological dominance in the digital asset sphere. While the specifics remain cloaked in mystery, the implications are profound. The move hints at a strategic attempt by one of the country’s largest exchanges to not…

Nasdaq’s New Crypto Governance: A Necessary Evil or Market Hampering Barrier?

The recent decision by Nasdaq to impose shareholder approval requirements on stock issuances used for purchasing cryptocurrencies marks a momentous shift in the landscape of digital asset integration within mainstream capital markets. From a center-right liberal perspective, this move can be viewed either as a prudent gauntlet ensuring investor oversight or as an unnecessary government-style…

Revolution or Recklessness? The Bold AI Surge Transforming Crypto Development

The incorporation of artificial intelligence into software development is no longer a matter of experimentation but has become a defining strategic move for innovative companies like Coinbase. With nearly half of its daily coding tasks now powered by AI, Coinbase’s leadership signals a seismic shift in how financial platforms approach technology. This aggressive push toward…

2025: The Illusion of Crypto Boom Hides Stark Reality of Failure

The latest filings from Gemini paint a picture that many in the market refuse to confront: despite the hype surrounding its upcoming IPO, the exchange is deeply unprofitable. With a staggering net loss of $282.5 million in the first half of 2025—more than seven times its loss from the same period last year—Gemini’s financial health…

Unveiling the Illusion: Is Crypto-Linked Stock Trading a Ill-Advised Mirage for Investors?

In a bold move that blurs the lines between traditional finance and the volatile realm of digital assets, MEXC has launched stock futures tied to a NASDAQ-listed company, Tron Inc., on its platform. While the touted benefits—zero trading fees, high leverage, and seamless access—appear appealing on the surface, their underlying implications warrant a skeptical eye.…

5 Critical Flaws in the Crypto Industry’s Resilience That Could Undermine Its Future

Despite headline-grabbing numbers suggesting remarkable year-over-year growth, the recent financial disclosures from platforms like Robinhood and Kraken reveal an industry that’s overly optimistic about its resilience in the face of ongoing volatility. Robinhood’s 45% YoY revenue increase, driven by a 98% surge in crypto-related income, appears impressive at first glance. However, these figures obscure a…

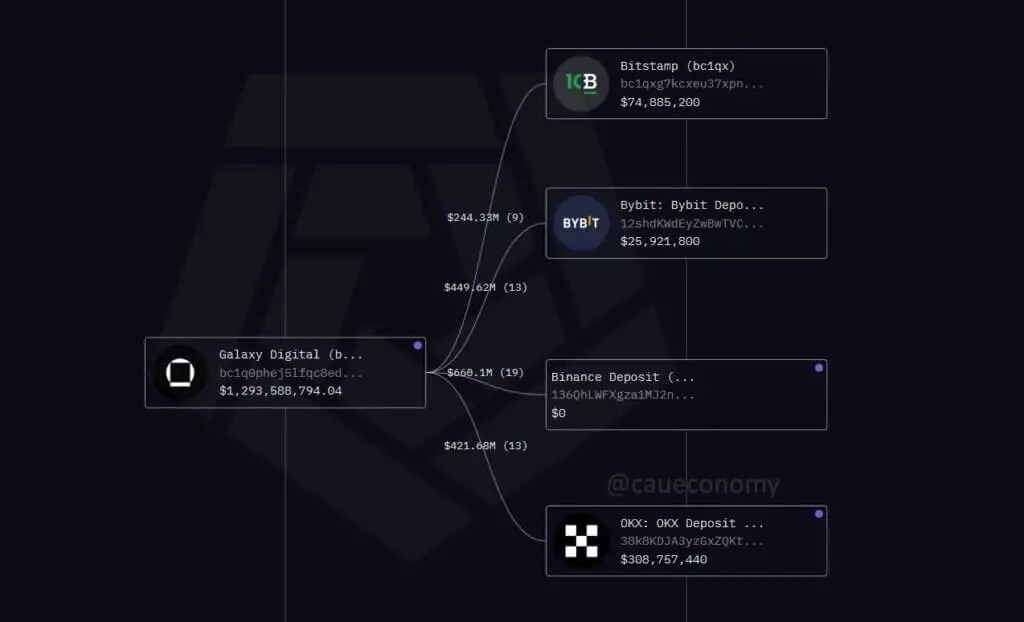

Unraveling the Cryptocurrency Surge: A Sign of Stabilization or a Dangerous Decline?

Recent data reveals a significant movement of Bitcoin from Galaxy Digital, one of the most prominent institutional players, involving the transfer of over 17,000 BTC—valued at approximately $1.7 billion—within a mere 24 hours. This wave of transactions raises critical questions about the current health and future trajectory of the crypto market. While some interpret this…

The Unstoppable Rise of AI-Driven Trading: How Gen Z’s Shift Will Reshape the Financial Landscape

In recent years, a seismic transformation has subtly taken root within the financial sector, driven predominantly by the strategic embrace of artificial intelligence among Generation Z traders. Unlike their predecessors, who relied heavily on manual analysis and gut instincts, Gen Z is harnessing AI as a core component of their trading arsenal. This shift is…

Unveiling the Truth Behind FTX’s Fragile Recovery: A Mirage of Prosperity or a Poisoned Chalice?

FTX’s recent announcement of a planned distribution to creditors might seem like a beacon of hope after the chaos and devastation following its collapse. However, beneath this carefully crafted narrative lies a fragile, possibly deceptive facade. The scheduled payouts, set for late September, are a testament not to restored stability but to a meticulously managed…

Unraveling Lies: Why the DOJ’s Mysterious Closure of the Kraken Case Signals a Broader Fail in Federal Oversight

The recent closure of the FBI investigation into Jesse Powell, founder of Kraken, exposes far more than a simple legal misstep; it reveals a troubling pattern of federal overreach cloaked in sensationalism. While the Department of Justice’s decision to drop the case might seem like a victory for Powell, it’s essential to scrutinize the deeper…

Why BitGo’s IPO Could Signal Disillusionment with Crypto Stability

The decision by BitGo to file confidential paperwork for an initial public offering might seem like a robust endorsement of the digital asset sector’s growing legitimacy. However, upon closer examination, it reveals more about the sector’s fragility than its resilience. As a company rooted in security and institutional custody, BitGo’s move to go public is…