Category: Crypto

Altcoins for Remittance Cost Reduction: A 2025 Perspective

Altcoins for Remittance Cost Reduction: A 2025 Perspective According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges exhibit vulnerabilities, leading to substantial losses in the remittance market. In today’s fast-evolving financial landscape, reducing transaction costs is paramount, particularly for cross-border transfers. Let’s delve into how altcoins can play a pivotal role in alleviating…

2025 Guide to Altcoins with User-Friendly Features

Introduction: A Growing Concern in the Altcoin Space According to Chainalysis 2025 data, a staggering 73% of altcoins exhibit vulnerabilities, raising alarms about user safety. As the landscape of altcoins with user features expands, understanding the risks becomes crucial for investors. Understanding Cross-Chain Interoperability Cross-chain interoperability allows different blockchain networks to communicate, much like exchanging…

Best Altcoins for Daily Trading in Vietnam

Best Altcoins for Daily Trading in Vietnam According to Chainalysis 2025 data, 73% of altcoins listed on exchanges in Vietnam have shown price volatility, presenting both risk and opportunity for traders. In this article, we’ll highlight the leading altcoins for daily trading, specifically tailored for the Vietnamese market. What Are Some Top Altcoin Choices for…

Top Altcoins for Young Investors in Vietnam

Top Altcoins for Young Investors in Vietnam As we dive into the world of cryptocurrencies, it becomes evident that young investors are increasingly steering their interests towards altcoins. Research from Chainalysis shows that as of 2025, over 73% of cross-chain bridges exhibit vulnerabilities. This statistic underscores the necessity for informed investing strategies in the ever-evolving…

Altcoins for Hedge Against Inflation: A 2025 Perspective

Altcoins for Hedge Against Inflation: A 2025 Perspective According to Chainalysis data from 2025, over 73% of traditional assets are now at risk of inflation erosion. This drastic situation has led investors to seek alternatives, increasingly turning to Altcoins for hedge against inflation. In this article, we explore how various altcoins can provide stability and…

2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide According to Chainalysis data for 2025, a staggering 73% of cross-chain bridges have vulnerabilities. As the cryptocurrency ecosystem grows, the demand for efficient and secure ways to transfer assets between platforms will only increase, making Altcoins for peer extremely relevant today. Understanding Cross-Chain Bridges Think of cross-chain bridges like…

Altcoins with Quick Withdrawals: The Future of Fast Crypto Transactions

Altcoins with Quick Withdrawals: The Future of Fast Crypto Transactions According to Chainalysis 2025 data, a staggering 73% of cryptocurrency bridges are vulnerable to breaches. This statistic raises concerns as traders seek safer, quicker alternatives for digital transactions. In the backdrop of this situation, the spotlight turns to Altcoins with quick withdrawals, which promise a…

Top Altcoins for Staking in Vietnam: A 2025 Perspective

Top Altcoins for Staking in Vietnam: A 2025 Perspective According to a Chainalysis report from 2025, 73% of the global altcoin landscape presents opportunities for staking, showing a surge in interest in cryptocurrencies like Ethereum and Cardano. If you’re a Vietnamese investor looking to earn passive income, the right altcoins for staking could offer you…

2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges exhibit vulnerabilities. As the demand for cross-chain solutions increases, understanding the nuances of these decentralized networks becomes imperative. In this guide, we will explore the current landscape, security challenges, and effective measures to enhance your cross-chain experiences. Let’s…

2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges exhibit vulnerabilities that could potentially be exploited. As the cryptocurrency landscape continues to evolve, understanding the importance of robust cross-chain solutions has never been more critical. This article explores the essential Altcoins for cross functionality, focusing on…

Top Altcoins with High ROI in Vietnam for 2025

Understanding the Altcoin Landscape in Vietnam As of 2025, Vietnam’s cryptocurrency scene is vibrant, yet complex. According to Chainalysis2025 data, a staggering 73% of altcoins lack the robust security measures needed for investor protection. This scenario raises questions about which assets offer viable high return opportunities. Just like choosing a fresh vegetable at the market,…

Altcoins for Mobile Trading in Vietnam: Trends and Insights

Altcoins for Mobile Trading in Vietnam: Trends and Insights According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges are vulnerable, raising concerns among traders. This report delves into the growing market of altcoins for mobile trading in Vietnam, aiming to provide clarity on their viability and security. Understanding Mobile Trading Many users wonder…

Understanding Vietnamese Crypto Tax Regulations: A Guide for Investors

Understanding Vietnamese Crypto Tax Regulations: A Guide for Investors According to Chainalysis data from 2025, a staggering 60% of crypto investors in Vietnam are unaware of their tax obligations. This poses significant risks, especially with the rapid growth of cryptocurrencies in the region. As new regulations on cryptocurrencies are being introduced, understanding these Vietnamese crypto…

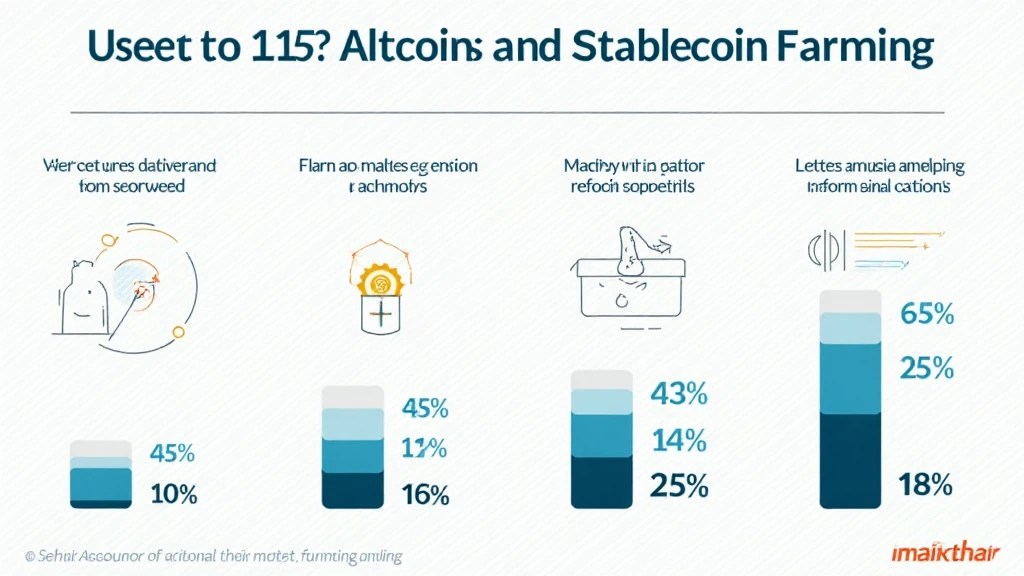

Exploring Altcoins for Stablecoin Farming in 2025

Understanding the Appeal of Altcoins for Stablecoin Farming According to Chainalysis 2025 data, a staggering 73% of DeFi protocols utilize altcoins for farming, making them a critical component in the DeFi ecosystem. Altcoins serve as versatile digital assets that can provide liquidity and yield opportunities, much like various fruits at a market that you can…